Business Insurance in and around Beacon

Calling all small business owners of Beacon!

Cover all the bases for your small business

- Fishkill, NY

- Dutchess County

- Hudson Valley

- Cold Spring, NY

- Pennsylvania

- Connecticut

- Wappingers Falls, NY

- Glenham, NY

- Newburgh, NY

- Garrison, NY

Cost Effective Insurance For Your Business.

It's a lot of responsibility to start and run a business, but you don't have to figure it out all by yourself. As someone who also runs a business, State Farm agent Caitlin McVicker is aware of the work that it takes and would love to help lift some of the burden. This is protection you'll definitely want to investigate.

Calling all small business owners of Beacon!

Cover all the bases for your small business

Protect Your Future With State Farm

State Farm has provided insurance to small business owners for almost 100 years. Business owners like you have relied upon State Farm for coverage from countless industries. It doesn't matter if you are a real estate agent or an electrician or you own a pottery shop or a camera store. Whatever your business, State Farm might help cover it with customizable policies that meet each owner's specific needs. It all starts with State Farm agent Caitlin McVicker. Caitlin McVicker is the agent who can relate to where you are firsthand because all State Farm agents are business owners themselves. Contact a State Farm agent to understand your small business insurance options

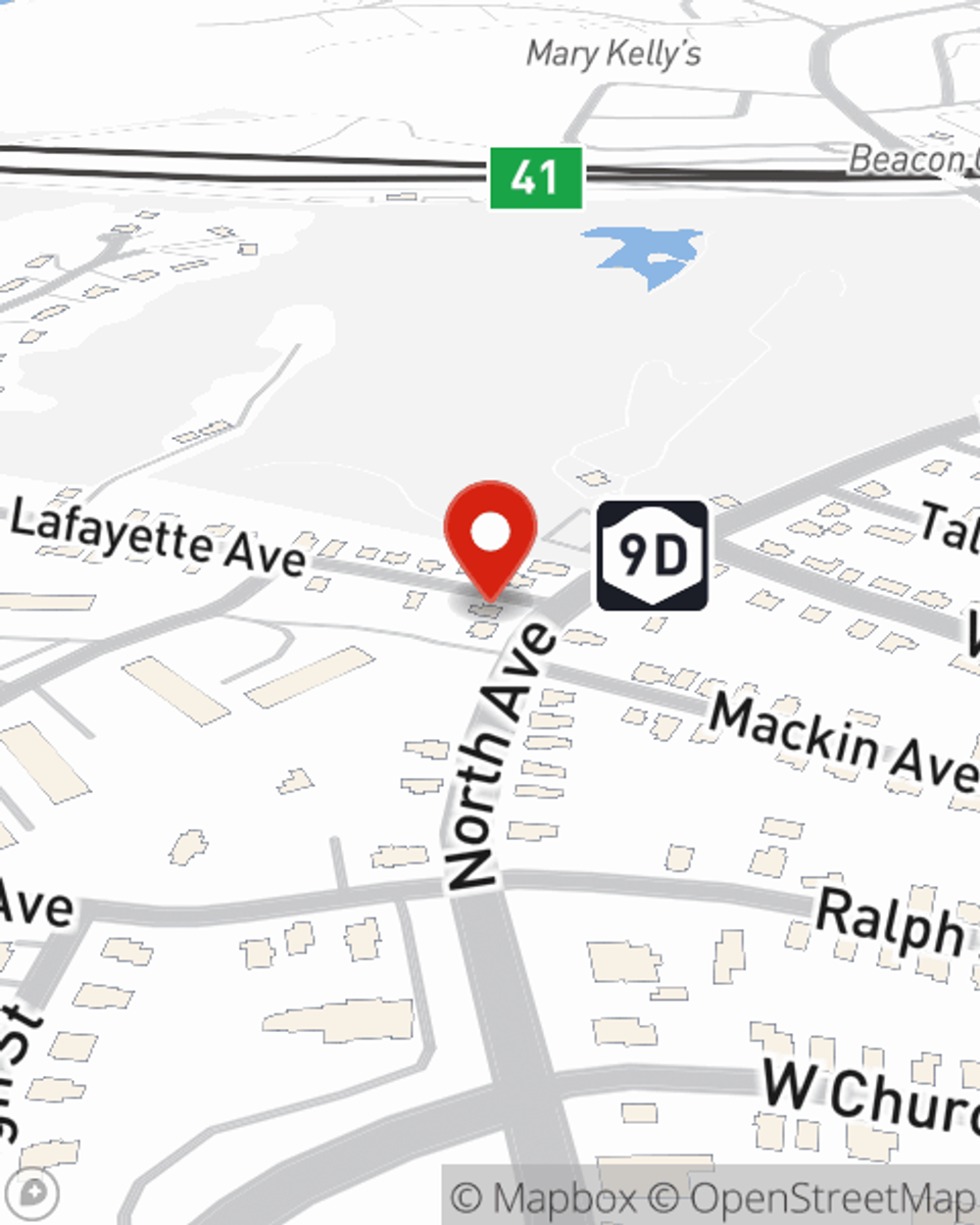

Reach out to State Farm agent Caitlin McVicker today to explore how one of the leading providers of small business insurance can safeguard your future here in Beacon, NY.

Simple Insights®

Protect your business property from slip and falls

Protect your business property from slip and falls

Decrease the chances of slips, trips and falls at your business with proper maintenance and safety procedures.

What are typical landlord maintenance responsibilities?

What are typical landlord maintenance responsibilities?

As a landlord, there are certain maintenance responsibilities associated with the property. Equip yourself to better address repairs while minimizing preventable issues.

Caitlin McVicker

State Farm® Insurance AgentSimple Insights®

Protect your business property from slip and falls

Protect your business property from slip and falls

Decrease the chances of slips, trips and falls at your business with proper maintenance and safety procedures.

What are typical landlord maintenance responsibilities?

What are typical landlord maintenance responsibilities?

As a landlord, there are certain maintenance responsibilities associated with the property. Equip yourself to better address repairs while minimizing preventable issues.